If you own cryptocurrencies, you’re already aware that one of the biggest risks isn’t market volatility—it’s security. Countless users have lost their assets not because of poor investment decisions, but because of compromised exchanges, phishing scams, or hacked online wallets. This is where hardware wallets step in as one of the safest options to store crypto assets securely.

In this in-depth guide, we’ll explore what a hardware wallet is, how it works, why it offers superior security, and how you can start using one to protect your digital wealth.

What is a Hardware Wallet?

A hardware wallet is a physical device that stores your private keys—the cryptographic codes that prove your ownership of cryptocurrencies—completely offline. This air-gapped approach dramatically reduces the risk of your keys being exposed to hackers, viruses, or internet-based attacks. These devices are often about the size of a USB stick and are designed specifically to safeguard digital assets.

Unlike storing crypto on an exchange or a mobile app (known as hot wallets), a hardware wallet ensures that even if your phone or computer is compromised, your crypto stays safe. The wallet only connects to the internet temporarily and only when you choose to make a transaction. This makes it a favorite among long-term investors, high-value asset holders, and security-conscious users.

How is it Different from a Software Wallet?

While both hardware and software wallets serve the same basic function—managing private keys—they differ significantly in security and use case. Software wallets are typically apps installed on your smartphone or computer. They’re user-friendly and convenient, especially for day-to-day transactions. However, since they’re always connected to the internet, they’re more susceptible to threats such as malware, phishing, and remote access attacks.

Hardware wallets, in contrast, remain disconnected from the internet unless actively used. Even during transactions, the private key never leaves the device. This fundamental design difference is what makes hardware wallets the go-to choice for long-term storage and protection against unauthorized access.

In short, if you prioritize convenience and speed, a software wallet might suffice. But if your top concern is security—especially for large sums—a hardware wallet is the clear winner.

How Does a Hardware Wallet Work?

This is where the magic happens—and where most newcomers get curious. A hardware wallet doesn’t store your cryptocurrency itself. Instead, it stores your private keys, which are essentially the password to access your funds on the blockchain. The actual assets live on the blockchain network, but the private key gives you exclusive control over them.

So how does it all come together?

When you want to receive crypto, the hardware wallet provides you with a public address—like an email address someone can send funds to. This can be shared freely. But when you want to send crypto, that’s when the private key comes into play.

Here’s how a typical transaction works:

- You connect the wallet to your device (usually via USB or Bluetooth).

- You open a companion app like Ledger Live or Trezor Suite to prepare the transaction.

- The app creates an unsigned transaction—meaning it lacks the approval of your private key.

- The hardware wallet receives this unsigned transaction and prompts you to confirm the details on its secure screen (amount, recipient address, network fees).

- If everything looks right, you confirm the transaction physically on the device.

- The device uses your private key (which never leaves it) to sign the transaction.

- The signed transaction is sent back to the app, which then broadcasts it to the blockchain.

Because your private key never enters your computer or touches the internet, even if your device is compromised, hackers cannot access your funds. This unique signing mechanism is what gives hardware wallets their exceptional security profile.

In addition, many hardware wallets include features like:

- Secure Element Chips (SE): Used in banking cards and passports, these chips resist tampering.

- PIN and Passphrase Protections: Adding multiple layers of defense.

- Recovery Seed Generation: During setup, the wallet generates a 12–24 word backup phrase. If the device is lost or damaged, your wallet can be restored on a new one using this seed.

Understanding this workflow is crucial, especially if you manage a significant crypto portfolio. With a hardware wallet, you’re not just storing assets—you’re taking full custody of your digital freedom.

Why Use a Hardware Wallet?

You may wonder, “Do I really need a hardware wallet if I’m only holding a small amount of crypto?” That depends on your risk tolerance, investment goals, and how much you value control over your assets.

The primary benefit of using a hardware wallet is security. With increasing hacks on centralized exchanges and malicious apps, the industry mantra “Not your keys, not your coins” has never been more relevant. When you use an exchange, you’re essentially trusting a third party to manage your private keys. With a hardware wallet, you hold the keys—literally.

Other benefits include:

- Immunity to Remote Hacks: Since the device isn’t connected to the internet 24/7, it’s insulated from most digital threats.

- Tamper-Proof Design: Many wallets self-wipe if tampered with physically.

- No Dependence on Platforms: Exchanges can freeze assets or go bankrupt (as seen with FTX). Hardware wallets eliminate this risk.

- Multi-Asset Support: You can store multiple cryptocurrencies—including Bitcoin, Ethereum, stablecoins, and altcoins—in a single device.

- Full Ownership: You don’t rely on anyone else for access. There’s no login, no downtime, and no middleman.

Of course, with great power comes great responsibility. You are in charge of protecting your seed phrase, updating firmware, and avoiding scams. But for most users, the benefits far outweigh the effort.

What Are the Advantages of Hardware Wallets?

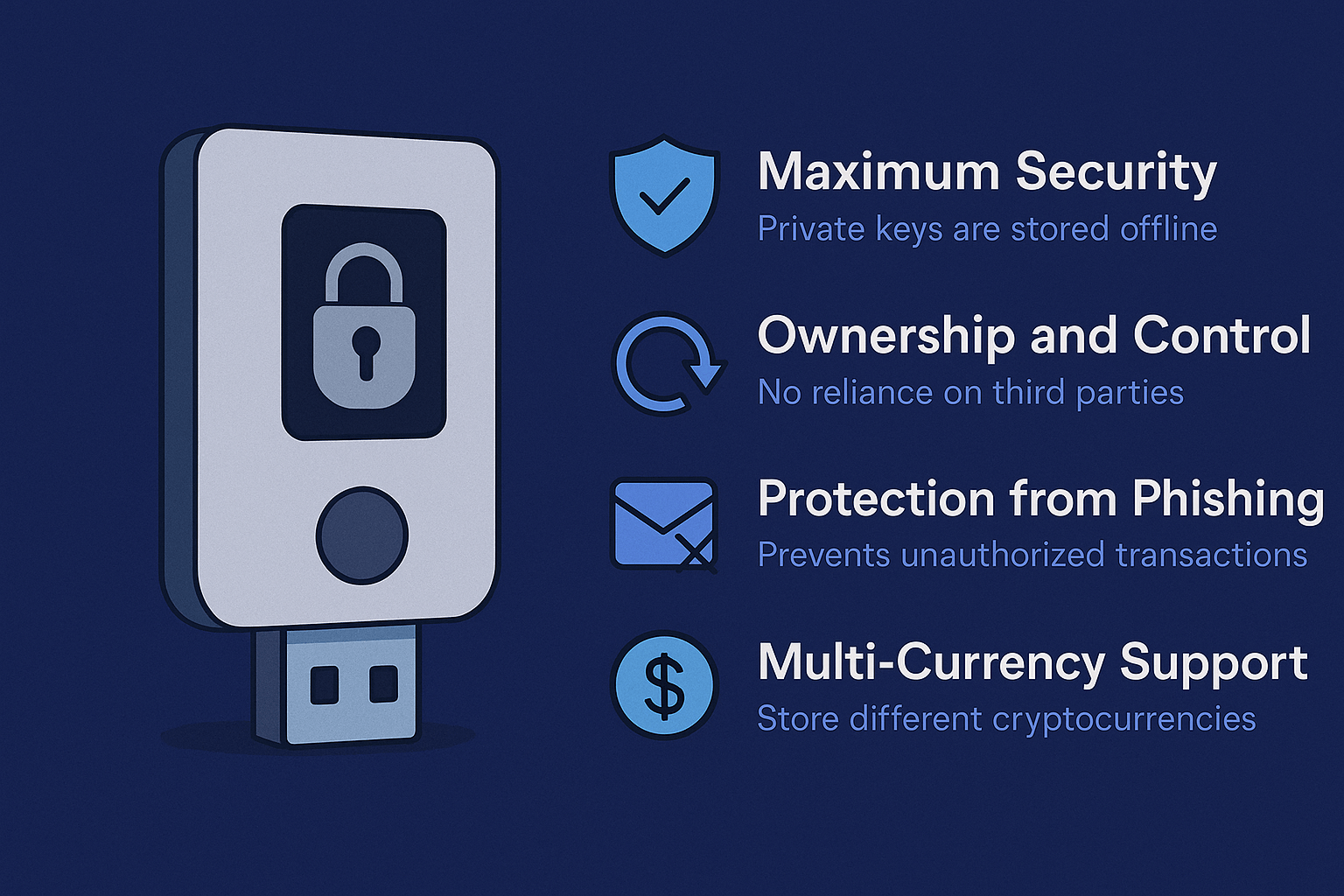

When it comes to storing crypto assets securely, hardware wallets offer a level of protection that far exceeds most alternatives. These physical devices are purpose-built to isolate your private keys from online threats, giving users unmatched control and peace of mind. Whether you’re a long-term investor or simply security-conscious, the benefits are hard to ignore.

Here are the key advantages of using a hardware wallet:

- Maximum Security: Your private keys remain offline and inaccessible to malware or hackers.

- Ownership and Control: You don’t rely on centralized platforms or third parties to access your funds.

- Resistance to Phishing Attacks: Hardware wallets physically verify transactions, eliminating the risk of fake confirmations.

- Multi-Asset Support: Most modern devices support a wide range of cryptocurrencies within a single device.

- Tamper-Proof Design: Many wallets include built-in protections against physical intrusion or manipulation.

- Perfect for HODLing: Ideal for users who plan to hold assets long term without regular transactions.

What Are the Disadvantages of Hardware Wallets?

While hardware wallets are among the most secure storage options for crypto, they’re not without their trade-offs. For users who value convenience, speed, or ease of use, certain aspects may pose challenges. It’s important to consider these drawbacks before committing to a hardware wallet.

Here are the main disadvantages:

- Maintenance Required: Firmware updates and basic operational discipline are necessary for continued security.

- Initial Cost: Unlike free software wallets, hardware wallets typically cost between $50 and $200.

- Setup Complexity: The installation and backup process can be intimidating for first-time users.

- Physical Vulnerability: The device can be lost, stolen, or damaged—although this risk is reduced if you securely store your recovery phrase.

- Less Convenient for Daily Use: Not ideal for users who frequently trade or need fast access to their assets.

How to Set Up and Protect Your Wallet

Setting up your hardware wallet properly is as important as using it. Follow these best practices to ensure your funds remain secure:

- Buy from Official Sources Only: Never buy used or from third-party sellers. A tampered wallet can be a trap.

- Initialize the Device Yourself: If the wallet arrives already initialized or with a pre-generated seed, don’t use it.

- Write Down Your Recovery Phrase: Store it offline in multiple secure locations. Consider using metal backup plates instead of paper.

- Enable a Strong PIN Code: Choose something unique and not easily guessable.

- Don’t Store Your Seed Digitally: Avoid taking photos or saving it in cloud storage.

- Keep the Firmware Updated: Manufacturers regularly release updates to patch security flaws or support new coins.

- Be Mindful of Social Engineering: Scammers may impersonate support teams or wallet manufacturers. Never share your seed phrase with anyone—ever.

Proper setup and operational discipline are what turn a secure device into an unbreakable vault for your digital assets.

Conclusion: Should You Get a Hardware Wallet?

If you’re serious about cryptocurrency—whether as a long-term investor or as someone holding meaningful value—a hardware wallet is not just a recommendation, it’s a necessity. With it, you gain true ownership, maximum control, and robust protection against virtually all types of attacks.

Yes, it requires some initial effort and learning. Yes, you are your own bank. But that’s exactly the point. In a world where centralized platforms can fail, be hacked, or shut down without notice, a hardware wallet puts the power—and responsibility—back into your hands. Whether you’re holding Bitcoin, Ethereum, or stablecoins, a hardware wallet gives you the confidence to manage your crypto wealth independently and securely.

FAQs About Hardware Wallets

❓Can a hardware wallet be hacked?

Hardware wallets are designed with extremely strong security measures, making remote hacking practically impossible. The private keys are never exposed to the internet, which eliminates most common attack vectors such as malware or phishing. The only realistic threat is if someone gains physical access to your device and also knows your PIN code or recovery phrase—which is why you should always keep those credentials private and secure. With proper handling, hardware wallets are virtually unhackable.

❓Is a hardware wallet better than a hot wallet?

Yes, especially when it comes to long-term security and self-custody. A hardware wallet stores your private keys offline, which protects you from online attacks, phishing scams, and exchange hacks. However, hot wallets are more convenient for quick access and daily trading, making them suitable for smaller balances or frequent use cases.

❓What happens if I lose my hardware wallet?

Losing your hardware wallet doesn’t mean losing your crypto—as long as you’ve safely backed up your recovery phrase. This 12–24 word phrase can be used to restore your wallet and access your funds from a new device. Without this phrase, however, there is no way to retrieve your assets, as there’s no central authority in crypto to help you recover them. That’s why it’s critical to store your recovery phrase securely and never share it with anyone.

❓Do I need internet to use a hardware wallet?

You don’t need internet to operate a hardware wallet, but you do need an internet connection to broadcast transactions to the blockchain. The device itself performs all critical operations—like signing transactions—offline, keeping your private keys completely isolated. Once the transaction is signed within the hardware wallet, it’s sent via a connected app (like Ledger Live or Trezor Suite) to the internet. This hybrid approach ensures maximum security while still allowing blockchain interaction when needed.

❓What if a hardware wallet fails?

If your hardware wallet becomes damaged or stops functioning, your funds are not lost—as long as you have your recovery phrase. This phrase allows you to restore your wallet and regain access to your crypto using a new device. That’s why it’s absolutely essential to store your recovery phrase in a safe and offline location. Even in the event of total hardware failure, your digital assets remain secure on the blockchain and can be accessed again.

❓Can I store multiple cryptocurrencies in one hardware wallet?

Yes, most modern hardware wallets support a wide range of cryptocurrencies, including Bitcoin, Ethereum, stablecoins, and hundreds of altcoins. You can manage different assets using a single device through dedicated apps or interfaces provided by the manufacturer. However, some lower-end wallets may have storage or compatibility limits, so it’s always good to check the supported coins list before purchasing. With the right wallet, you can conveniently secure and manage an entire crypto portfolio from one place.